In the insurance industry, agile quotes and efficient claims management are critical to customer satisfaction and agency profitability. Imagine being able to offer instant policy quotes and facilitate the first notice of loss (FNOL) process via WhatsApp, the preferred communication channel in Latin America. An intelligent chatbot can transform these key processes.

1. The Policy Issuance Funnel and Claims Management: Current Challenges

Insurance agencies and brokers face constant challenges on two main fronts: acquiring new customers (issuing policies) and handling claims.

Challenges in Policy Issuance:

- Slow Quotation Process: Manually gathering customer information and calculating premiums for different coverages can be time-consuming, causing the prospect to shop around.

- Limited Availability for Consultations: Potential clients often research and request quotes outside of business hours.

- Comparing Multiple Options: Customers want to compare different types of insurance (auto, home, life, medical) and coverage.

- Prospect Tracking: Follow up with those who requested a quote but did not purchase immediately.

Challenges in Claims Management:

- First Notice of Loss (FNOL) Inefficient: Gathering all the necessary information during a phone call, especially during a stressful time for the policyholder, can be complicated.

- Incomplete Documentation: Difficulty for policyholders to submit all required documents in a timely manner.

- Lack of Clear Updates: Policyholders often feel anxious about not having information about the status of their claim.

- High Volume of Claims Inquiries: Repetitive questions about the process, documentation, and resolution times.

Analyze your Insurance Agency:

To understand the potential of a chatbot, consider:

- What are your main lines of business (types of insurance you sell the most)? Could you standardize the initial quote for them?

- What's the average time it takes you to process a claim from initial notification to resolution? Where are the bottlenecks?

- What is the average premium value of the policies you issue? How many quotes do you need to generate to close a sale?

- What is your current communication with customers during the claims process?

2. AI for Instant Policy Pricing and Quotation

A WhatsApp chatbot, integrated with your pricing systems or using AI models, can revolutionize the quoting process:

- 24/7 Prospect Data Collection: The chatbot can request the information needed to obtain a quote (e.g., for car insurance: make, model, year, driver's age, zip code; for life insurance: age, habits, desired insured amount).

- Real-Time Quote: Based on the entered data and pricing rules, the chatbot can present one or more quote options instantly.

- Coverage Comparison: Explain in a simple way what each policy option includes and its benefits.

- Submission of Detailed Proposals: Generate and send a PDF with the formal quote and terms and conditions.

- Scheduling a Call with an Advisor: If the prospect has complex questions or is ready to buy, the chatbot can schedule a call with an insurance agent.

- Automated Tracking: For prospects who don't buy right away, the chatbot can schedule a friendly follow-up a few days later.

3. Streamlining First Notice of Loss (FNOL) and Claims Management

When an accident occurs, speed and clarity are essential. A WhatsApp chatbot can be the ideal first point of contact:

- FNOL Reception 24/7: Policyholders can report a claim at any time, including on weekends or at night.

- Step-by-Step Guide to Reporting: The chatbot can guide the insured through the necessary questions to gather essential information about the incident (what happened, when, where, who was involved, type of damage/loss).

- Application and Initial Documentation Upload: The insured can take photos of the damage, along with documents (license, registration card, police report, if applicable) and send them directly via WhatsApp.

- Assignment of a Claim Number: Inform the insured of the assigned claim number for follow-up.

- Information on Next Steps: Clearly explain what will happen next (e.g., contacting an adjuster, additional documents required, estimated times).

- Claim Status Updates: Integrated with the claims management system, the chatbot can provide proactive or on-demand updates to the insured.

Generic Use Case: “Total Confidence Insurance” and its Improved Efficiency

“Seguros Confianza Total” is a brokerage that handled a high volume of quotes and claims. The manual process was slow and error-prone, affecting customer satisfaction.

By implementing a WhatsApp chatbot, they achieved:

- Reduce the average time to generate an auto insurance quote from 30 minutes to less than 2 minutes.

- Increase the number of quotes generated by 20%, being available 24/7.

- Facilitate the reporting of claims (FNOL), allowing customers to submit photos and details instantly, which expedited the opening of 40% files.

- Reduce calls to the contact center by 30% asking about the status of a claim, thanks to the chatbot's proactive updates.

- Improve the accuracy of data collection for both quotes and claims.

The chatbot has become a vital tool for improving operational efficiency and customer experience at key moments.

5. Regulatory Compliance and Information Security in the Insurance Sector

The insurance sector is highly regulated. When using chatbots, it's crucial to ensure compliance and the protection of sensitive data:

- Protection of Personal Data: Comply with the data protection laws applicable in each Latin American country (e.g., LFPDPPP in Mexico, LGPD in Brazil).

- Explicit Consent (Opt-In): Obtain clear permission from the customer to interact and send information via WhatsApp.

- Security in Data Transmission and Storage: Use chatbot platforms and BSPs that offer encryption and robust security measures.

- Information Retention Policies: Define how and for how long customer conversations and data will be stored.

- Transparency in the Use of AI: If AI is used for pricing or risk assessment, be transparent about its use (if required by regulation).

- Compliance with Sector Specific Regulations: Adhere to the regulations of the insurance superintendency or the corresponding regulatory body in each country.

Check Compliance at your Agency:

- How do you currently ensure the confidentiality and security of your clients' and prospects' information?

- Are you aware of all the data management and communication regulations that apply to your insurance agency?

- What security and compliance protocols will you require from your chatbot provider?

Conclusion: Modernize your Insurance Agency with the Agility and Efficiency of WhatsApp

For insurance agencies in Latin America, a WhatsApp chatbot offers an unprecedented opportunity to streamline policy quoting, improve first notice of loss management, and optimize overall customer communication. By automating key processes and being available 24/7, it not only improves operational efficiency and reduces costs, but also increases customer satisfaction at crucial moments. Adopting this technology, with a strong focus on compliance and security, is a strategic step toward the future of the insurance industry.

Optimize your business today!

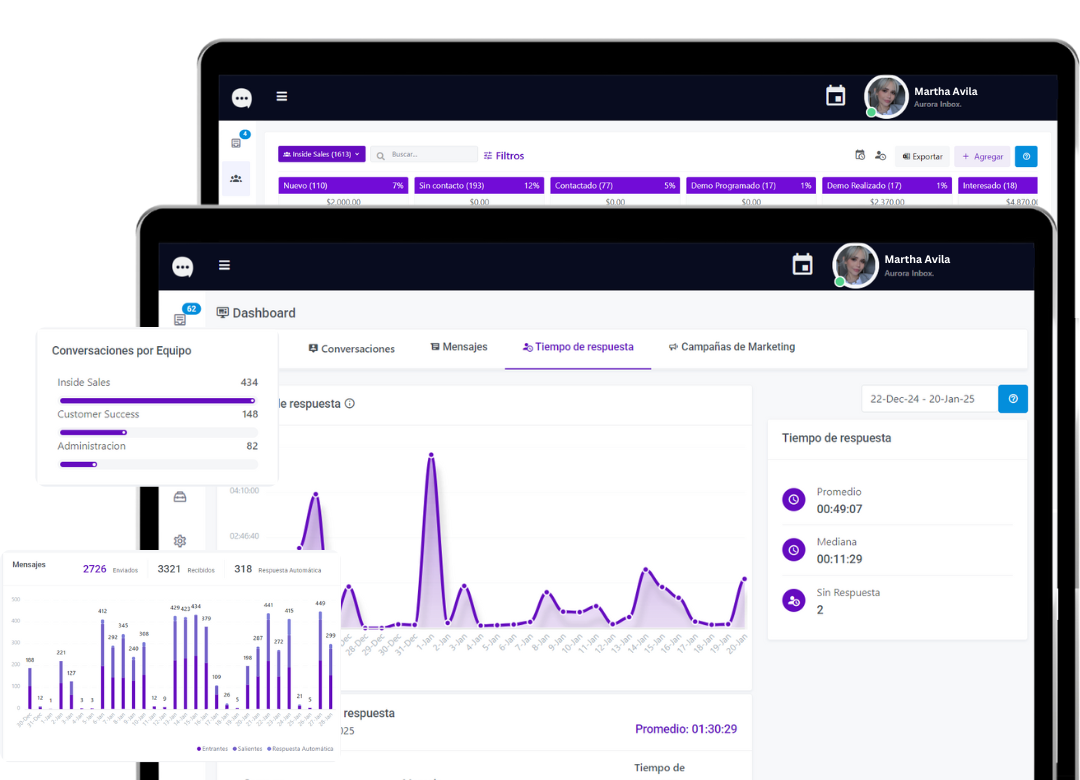

Find out how Aurora Inbox's AI agent for WhatsApp can revolutionize your customer service. Schedule a meeting to meet with him and take your service to the next level.

We are here to help you grow!