For accounting firms and financial advisors, clear communication with clients, timely reminders of tax obligations, and efficient document management are essential. How can you address frequent inquiries, remind you of SAT (or the corresponding tax authority) deadlines, and facilitate secure and automated document uploads? A WhatsApp chatbot is the ideal tool to modernize your practice and offer a value-added service.

1. Common Challenges for SMEs and the Workload in Accounting Firms

Accounting and finance firms serve a variety of clients, primarily SMEs, who often face challenges in keeping up with their tax and financial obligations. This translates into a considerable workload for the firms:

- Repetitive Customer Inquiries: Questions about the status of your tax returns, the meaning of tax terms, documents required for certain procedures, etc.

- Tax Deadline Reminder: Ensure clients file their returns and taxes on time to avoid fines and surcharges.

- Collection of Documentation: Obtain invoices, statements, receipts, and other necessary documents from clients in an organized and timely manner.

- Communication of Tax News: Keep clients informed about changes in tax laws or regulations that affect them.

- Multiple Client Management: Provide personalized follow-up to each client and their tax specificities.

Automating certain tasks with a chatbot can free up valuable time for accountants and advisors to focus on strategic analysis and higher-value advice.

Analyze your Office and Clientele:

To understand how a chatbot can be useful, consider:

- What are the most important tax due dates for most of your clients (e.g., monthly or annual returns, provisional payments)?

- What types of accounting or financial services are most in demand by your clients?

- Do you sign Non-Disclosure Agreements (NDAs) with your clients? How do you manage this process?

- How much time does your staff spend answering frequently asked questions or reminding clients to submit documents?

2. The Chatbot as a Tax Assistant: Reminders and Smart Calendar

A WhatsApp chatbot can act as a proactive tax assistant for your clients:

- Interactive Fiscal Calendar: Customers can check important deadlines (returns, payments) directly on WhatsApp.

- Automated and Personalized Reminders:

- Send reminders a few days before tax due dates.

- Customize reminders based on tax regime or customer type.

- Tax News Alerts: Communicate in a massive (but segmented if necessary) manner relevant changes in tax legislation that may affect clients.

- Document Checklists: For each type of declaration or procedure, the chatbot can provide a list of the documents the customer needs to prepare.

- Resolution of Basic Tax FAQs: Answer common questions about tax concepts, how to obtain certain receipts, etc.

3. Facilitating Secure Document Upload and Communication

Document collection is a critical and often tedious task. A chatbot can simplify it:

- Structured Request for Documents: The chatbot can clearly and orderly request the documents needed for a specific procedure.

- Instructions for Safe Loading: Although WhatsApp allows uploading files, for highly sensitive documents, the chatbot can direct the customer to a secure portal or encrypted email for uploading, or explain how to send them securely if done via WhatsApp (e.g. zipped with a password, if the customer has the knowledge).

- Confirmation of Receipt: Notify the client when documents have been received (whether the receiving process is integrated or updated manually).

- Direct Communication Channel for Quick Questions: Customers can ask specific questions about the required documentation.

- Scheduling Appointments with the Accountant/Advisor: If the client needs a more in-depth consultation, the chatbot can facilitate scheduling.

Generic Use Case: “ContaPro Asesores” and the Optimization of its Service

“ContaPro Asesores” is an accounting firm that serves numerous SMEs. They spent a lot of time reminding clients about tax deadlines and chasing down documents, in addition to answering the same questions over and over again.

By implementing a WhatsApp chatbot, they achieved:

- Reduce the time spent sending manual reminders by 70% of tax obligations.

- Improve the rate of on-time document delivery by clients in a 30%, thanks to the chatbot's clear reminders and checklists.

- Automate the response to the 60% FAQ of customers, freeing up accountants' time.

- Implement a system where the chatbot sent alerts about important tax changes, keeping customers better informed.

- Provide a channel for customers to request appointments for personalized advice more quickly.

The chatbot allowed ContaPro Asesores to offer a more proactive and efficient service, improving its relationships with its clients and optimizing its own resources.

5. Information Security and Confidentiality in the Accounting-Financial Field

The confidentiality and security of clients' financial and tax information are absolutely critical. When using a WhatsApp chatbot, extreme precautions must be taken:

- Non-Disclosure Agreements (NDA): Ensure that NDAs with clients cover communication through digital channels, or have a clear process for signing them before sharing sensitive information.

- Robust Privacy Policies: Inform customers in detail about how their information will be handled through the chatbot.

- Choosing Secure Platforms: Work with chatbot providers and BSPs that offer high standards of encryption and data security, complying with WhatsApp regulations and local laws.

- Secure Channels for Sensitive Documents: For the exchange of highly confidential financial documents, consider whether WhatsApp is the most appropriate channel or whether the chatbot should direct to encrypted portals or more secure delivery methods. Educate the client about the risks.

- Authentication and Verification: If customer-specific data is discussed, implement methods to verify the identity of the interlocutor.

- Staff Training: Ensure that office staff understand security protocols when interacting with chatbot information.

Reflect on Security in your Office:

- How do you currently manage the confidentiality of your clients' information?

- What type of information do you consider too sensitive to be discussed or sent directly via WhatsApp, even with a chatbot?

- What security and NDA signing protocols have you implemented or could you implement?

Conclusion: Modernize your Accounting and Finance Office with the Efficiency of WhatsApp

For accounting firms and financial advisors in Latin America, a WhatsApp chatbot offers a way to optimize client communication, automate crucial reminders, and streamline information gathering. By freeing up time from repetitive tasks, professionals can focus on providing more impactful strategic advice. However, this efficiency must always go hand in hand with an unwavering commitment to information security and client confidentiality. With careful and secure implementation, a chatbot can be a great ally for the growth and modernization of your practice.

Optimize your business today!

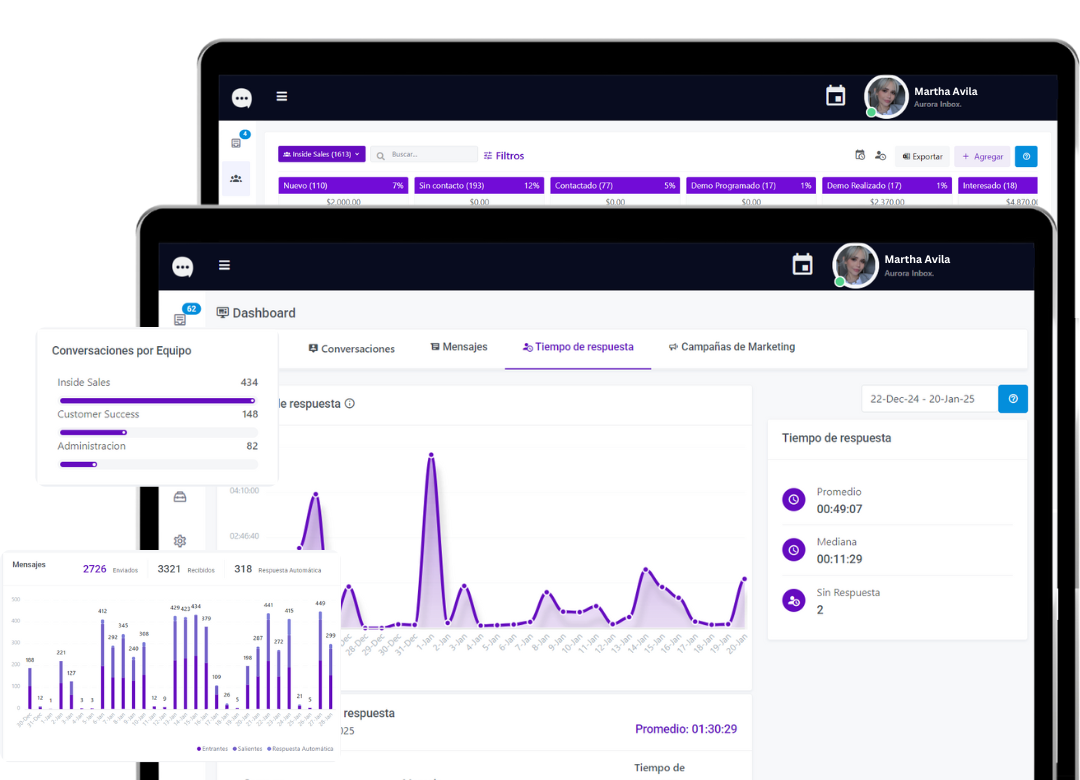

Find out how Aurora Inbox's AI agent for WhatsApp can revolutionize your customer service. Schedule a meeting to meet with him and take your service to the next level.

We are here to help you grow!