A complete guide to WhatsApp collections for SMEs: effective strategies and automation

The definitive guide to implement professional and effective collections via WhatsApp. Strategies, templates, legal framework and automation with Aurora Inbox for SMEs in Latin America.

Introduction to WhatsApp collection

Collections via WhatsApp has revolutionized portfolio management for SMEs in Latin America, transforming a traditionally tedious and conflictive process into a direct, personal and effective communication. With more than 2 billion active users and a penetration of more than 90% in countries such as Mexico, Colombia, Peru and Argentina, WhatsApp has become the preferred channel for commercial communication, including payment recovery.

Companies that implement structured collection strategies via WhatsApp report 60-80% improvements in recovery rates compared to traditional methods such as phone calls or emails. This effectiveness is due to the immediate and personal nature of WhatsApp, which allows for constant communication without being intrusive, facilitating payment agreements and maintaining positive business relationships.

However, WhatsApp collection requires a professional and systematic approach that respects both legal regulations and communication best practices. This guide will provide you with a complete framework for implementing effective collections that not only improves your portfolio recovery, but also strengthens your customer relationships.

The difference between traditional collections and WhatsApp collections lies in the ability to have two-way conversations that allow you to understand the customer's situation, negotiate flexible terms, and find mutually beneficial solutions. This contrasts with one-way methods such as collection letters or automated calls that often generate resistance and deteriorate the business relationship.

Advantages of WhatsApp vs. traditional payment methods

WhatsApp collection offers significant advantages over traditional methods that have made it the preferred option for modern SMEs seeking to balance effectiveness with maintaining business relationships.

Immediacy and convenience

WhatsApp enables instant communication that customers can respond to at their convenience, eliminating the frustration of missed calls or restrictive schedules. Messages are delivered immediately and customers can respond from anywhere, facilitating communication and reducing barriers to payment.

This immediacy also benefits companies by allowing real-time tracking of the status of each account. Read messages provide confirmation that the communication reached the recipient, while quick responses indicate engagement and readiness to resolve the situation.

Effective two-way communication

Unlike formal collection letters or emails, WhatsApp facilitates natural conversations that allow you to understand each customer's specific circumstances. This two-way communication is crucial to identify temporary problems, negotiate realistic payment plans, and maintain positive business relationships.

The conversational nature of WhatsApp also makes it possible to clear up misunderstandings immediately, provide additional information about bills or services, and resolve disputes before they escalate into bigger problems.

Significantly lower costs

WhatsApp collection drastically reduces operating costs compared to traditional methods. It eliminates the expense of phone calls, mailings, and staff time spent on unsuccessful contact attempts. One person can handle multiple conversations simultaneously, maximizing operational efficiency.

Implementation costs are also minimal, especially when using free WhatsApp Business or solutions such as Aurora Inbox that automate much of the process without requiring significant investment in infrastructure.

Improved customer experience

WhatsApp provides a less intimidating and more personal experience than traditional collections methods. Customers feel more comfortable communicating through a familiar platform, which reduces the anxiety associated with collections processes and facilitates collaboration to find solutions.

The ability to share documents, payment voucher images, and payment links directly in the conversation simplifies the resolution process and reduces friction that could delay payment.

Traceability and complete documentation

WhatsApp provides a complete record of all communications, including timestamps, delivery confirmations, and conversation history. This documentation is valuable for both internal tracking and legal compliance, providing clear evidence of collection efforts.

Traceability also facilitates the transfer of cases between team members, ensuring continuity in communication and avoiding repetition of information or duplicated efforts.

Legal framework and best practices

WhatsApp collections must be done within the legal framework established in each Latin American country, respecting consumer rights and specific regulations on collection practices. Legal compliance not only protects your company from penalties, but also builds trust and facilitates customer cooperation.

General regulations in Latin America

Most Latin American countries have established regulations prohibiting abusive collection practices, including restrictive schedules, intimidating language, unauthorized contact with third parties, and excessive frequency of communication. These regulations apply equally to WhatsApp collections.

In Mexico, the Law for the Transparency and Ordering of Financial Services (LTOSF) establishes that collections must be conducted in a respectful manner, at appropriate times (8:00 AM to 9:00 PM), and without the use of offensive or intimidating language. Colombia has similar regulations under the Superintendencia Financiera that prohibit abusive practices and establish specific rights for debtors.

In Peru, the Consumer Protection Law and the rules of the Superintendency of Banking and Insurance regulate collection practices, while in Argentina, the Consumer Defense Law and Central Bank regulations establish the legal framework for portfolio recovery activities.

Best practices for legal compliance

Implement an explicit opt-in system where customers authorize communication via WhatsApp for collection issues. This authorization should be documented and can be obtained during the initial sales process or by specific confirmation prior to initiating collection communication.

Establish specific times for collection communication, typically between 8:00 AM and 8:00 PM on weekdays, avoiding weekends and holidays unless the customer has specifically authorized communication during these periods.

Maintain a professional and respectful tone in all communications, avoiding intimidating language, threats, or excessive pressure. Focus on finding collaborative solutions rather than simply demanding immediate payment.

Document all interactions including dates, times, message content, and customer responses. This documentation is crucial both for internal tracking and to demonstrate legal compliance in case of disputes.

Protection of personal data

WhatsApp debt collection involves the handling of sensitive personal information that must be protected according to applicable privacy regulations. This includes phone numbers, financial information, and debt details that require confidential handling.

Implements appropriate security measures to protect customer information, including restricted access to collection conversations, encryption of sensitive data, and clear policies on retention and disposal of personal information.

Ensure that only authorized personnel have access to collection information and that all team members are trained in data protection practices and legal compliance.

WhatsApp Business configuration for collections

The proper configuration of WhatsApp Business is essential to project professionalism and facilitate effective communication during the collection process. A well-structured configuration builds trust and makes it easier for customers to identify your company.

Optimized company profile

Set up a complete business profile that includes your official company name, professional logo, clear description of services, physical address, hours of operation, and additional contact information. This information helps customers identify legitimate communications and reduces the perception of spam.

Use a profile picture that clearly represents your brand, preferably your official logo in high resolution. Avoid personal photos or generic images that may confuse customers about the legitimacy of the communication.

The business description should be concise but informative, specifically mentioning that you use WhatsApp for business communication including billing and collection issues. This sets clear expectations from the first contact.

Organization of contacts and labels

Implement a tag system that allows categorizing contacts according to their account status: "Current", "Overdue 1-30 days", "Overdue 31-60 days", "Overdue +60 days", "On payment plan", "Disputed", etc. This organization facilitates systematic follow-up and the implementation of specific strategies for each category.

It also uses labels to indicate the type of customer: "Frequent customer", "New customer", "Corporate customer", "Individual customer", etc. This segmentation allows you to customize the collection approach according to the customer's profile and value.

Consider implementing labels for the customer's preferred payment method: "Bank Transfer", "Credit Card", "Cash", "Check", etc. This information speeds up the resolution process by suggesting appropriate payment methods.

Configuration of automated messages

Set up welcome messages that establish clear expectations about the purpose of the communication and response times. This is especially important for collections, where initial clarity can prevent misunderstandings later.

Implement absence messages that inform customers of expected service hours and response times. Include alternative contact information for emergencies or urgent situations.

Use quick responses for common messages such as payment receipt confirmation, receipt request, payment method information, and answers to frequently asked billing questions.

Integration with existing systems

If your company uses billing or CRM systems, consider integrating with WhatsApp Business to synchronize customer information and automate statement updates. This integration reduces manual errors and ensures that billing information is always up to date.

Aurora Inbox facilitates this integration by providing native connectors with popular billing and CRM systems, enabling automatic synchronization of customer data, account statements, and payment history directly into WhatsApp conversations.

Effective communication strategies

Effective communication in collections via WhatsApp requires a delicate balance between firmness and empathy, maintaining professionalism while building rapport that facilitates customer collaboration to resolve the payment situation.

Friendly collection approach

Amicable collections is based on the premise that most customers want to meet their obligations but may face temporary circumstances that make it difficult to pay on time. This approach seeks to understand the customer's situation and find mutually beneficial solutions rather than simply demanding immediate payment.

Always start collection conversations with a cordial and professional tone, acknowledging the existing business relationship and expressing genuine interest in maintaining it. Avoid starting with threats or ultimatums that may generate immediate resistance.

Use language that invites collaboration: "We want to help you resolve this situation" rather than "You must pay immediately". This approach reduces the client's defensiveness and increases the likelihood of obtaining useful information about his or her financial situation.

Customization based on customer history

Tailor your communication approach based on the customer's payment history, the existing business relationship, and the specific circumstances of the past due account. Customers with a history of on-time payments deserve a different approach than customers with recurring delinquencies.

For customers with a good payment history, focus on resolving any problems that may have caused the delay: invoices not received, problems with payment methods, or misunderstandings about terms. These customers typically want to resolve the situation quickly.

For customers with recurring delinquencies, maintain a firm but professional tone, setting clear expectations about consequences of non-payment while offering realistic options to regularize the situation.

Strategic communication timing

The timing of collection communication can significantly influence effectiveness. Avoid contacting customers during times that may be inconvenient or stressful, such as very early in the morning, during lunch hours, or late at night.

For corporate clients, respect business hours and consider typical corporate payment cycles. Many companies process payments on specific dates of the month, so proper timing can facilitate faster resolution.

For individual clients, consider factors such as typical paydays (fortnights, end of the month) and avoid periods of high financial stress such as the beginning of the school year or high spending seasons.

Gradual and structured scaling

Implement a gradual escalation process that increases the strength of the message while maintaining professionalism. This escalation should be predictable and give the client multiple opportunities to resolve the situation before escalating to more severe measures.

The first contact should be a friendly reminder that assumes good faith on the part of the customer. The second contact may express concern and request information about the situation. Subsequent contacts can be more direct about consequences while continuing to offer options for resolution.

Document each stage of escalation to ensure consistency and provide evidence of reasonable collection efforts in case it becomes necessary to proceed with legal action.

Message templates for different stages

Message templates provide consistency and professionalism in collection communication while allowing customization for specific situations. These templates should be tailored to the stage of delinquency, type of customer, and particular circumstances of each case.

Preventive reminders (before expiration)

Preventive reminders are one of the most effective tools to prevent delinquency, sent 3-5 days before the due date to give the customer enough time to arrange payment.

Preventive Reminder:

"Hello [Name], I hope you are well. I am writing to remind you that your invoice #[Number] for $[Amount] is due on [Date]. If you have already made payment, please ignore this message. If you need additional information or have any questions, I'll be happy to help - thank you for your preference!"

First post-event communication (1-7 days)

The first communication after the due date should maintain a friendly tone assuming that the delay may be due to an oversight or minor circumstance.

First Reminder:

"Hi [Name], I hope you are feeling well. I wanted to contact you because I see that your invoice #[Number] for $[Amount] was due on [Date] and we have not received payment yet. If you have already made the payment, please share the receipt with me. If there is any inconvenience, I would like to know your situation to see how we can help you. I look forward to hearing from you."

Intermediate follow-up (8-30 days)

Intermediate follow-up should express greater concern while maintaining openness to finding collaborative solutions.

Intermediate Follow-up:

"Hi [Name], I have been trying to contact you about your invoice #[Number] for $[Amount] that is [X days] past due. I understand that unforeseen situations can arise and I would like to know your current situation to find a solution that works for both of us. We can consider a payment plan or adjust the dates according to your possibilities. Please contact me to resolve this situation."

Formal communication (31-60 days)

Formal communication should be more direct about consequences while continuing to offer resolution options.

Formal Communication:

"Dear [Name], your account has an overdue balance of $[Amount] corresponding to invoice #[Number] that is [X days] past due. It is important that we regularize this situation to keep your account up to date and avoid affecting your credit history. I offer you the following options: [Payment options]. Please confirm which option suits you best or contact me to discuss alternatives."

Last chance (60+ days)

Last chance communication should be clear about immediate consequences while maintaining professionalism.

Last Chance:

"Dear [Name], after multiple contact attempts, your account remains $[Amount] over [X days] past due. To prevent this situation from being reported to credit bureaus and legal action, I need you to contact me by [Deadline] to regularize your account. We are still willing to consider payment options that fit your situation."

Confirmation of payment agreements

When a payment agreement is reached, it is crucial to document it clearly to avoid misunderstandings later on.

Confirmation of Agreement:

"Perfect [Name], I confirm our agreement for payment of $[Total Amount] as follows: [Payment Plan Detail]. I will send you friendly reminders before each payment date. I appreciate your commitment to regularize your account and we maintain our excellent business relationship."

Automation with Aurora Inbox

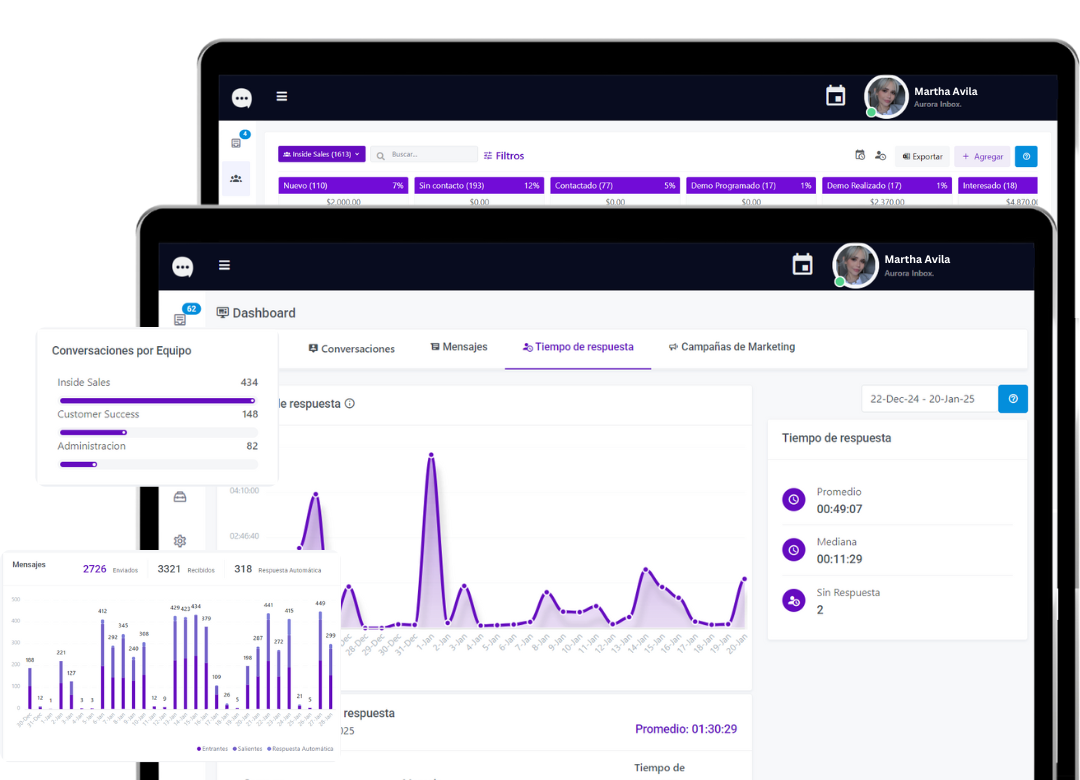

Aurora Inbox transforms WhatsApp collections from a labor-intensive manual process to an automated and intelligent system that maximizes portfolio recovery while minimizing operational burden. The platform combines sophisticated automation with human supervision to maintain the personal touch that characterizes effective collections.

Automation of collection sequences

Aurora Inbox allows you to set up automatic collection sequences that adapt to customer behavior and the specific characteristics of each account. The system can send preventive reminders, post-due follow-ups, and gradual escalations based on predefined rules and the customer's response history.

The sequences are automatically personalized with customer-specific information extracted from integrated billing systems, including names, amounts, due dates, and payment history. This personalization maintains the relevance and effectiveness of each communication without requiring manual intervention.

The system can also automatically pause sequences when the customer responds, transferring the conversation to a human agent for personalized handling. This combination of automation and human intervention optimizes both efficiency and effectiveness.

Artificial intelligence for personalization

Aurora Inbox uses artificial intelligence to analyze each customer's communication history and payment behavior, automatically adapting the tone, timing, and approach of collection messages to maximize the probability of positive response.

The system can identify patterns that indicate the best time of day to contact each customer, the type of message that generates the best response, and the optimal frequency of communication. This data-driven personalization significantly improves recovery rates compared to generic approaches.

AI can also detect signs of financial stress or changes in behavioral patterns that suggest the need for specialized human intervention or adjustments in collection strategy.

Integration with billing and ERP systems

Aurora Inbox integrates natively with popular billing and ERP systems, automatically synchronizing customer information, statements, and payment updates. This integration eliminates the need for manual data updates and ensures that billing information is always up to date.

When a customer makes a payment, the system automatically updates its status in Aurora Inbox, pausing active collection sequences and sending appropriate confirmations. This real-time synchronization prevents inappropriate communications and improves the customer experience.

The integration also allows the generation of consolidated reports that combine collection data from WhatsApp with financial information from the ERP, providing a complete view of the impact of the collection strategy on the company's cash flow.

Team management and supervision

Aurora Inbox facilitates the management of collection teams by providing dashboards that show individual and collective performance, automatic case distribution based on workload and expertise, and real-time monitoring of active conversations.

Supervisors can intervene in conversations when necessary, provide real-time coaching, and ensure that all communications meet established legal and quality standards.

The system also maintains complete records of all collection activities for audit, compliance, and performance analysis, facilitating continuous improvement of processes and results.

Collection metrics and KPIs

Systematic measurement of collections performance is critical to optimize strategies, identify opportunities for improvement, and demonstrate the ROI of WhatsApp collections implementation. The right metrics provide actionable insights that drive continuous improvement.

Collection effectiveness metrics

Recovery rate is the most important metric, measuring what percentage of the total past-due receivables are recovered within specific periods. Successful SMEs with WhatsApp collections typically achieve recovery rates of 70-85% in the first 30 days, compared to 40-60% using traditional methods.

The average recovery time measures how many days it takes from when an account becomes past due until it is regularized. WhatsApp typically reduces this time by 40-60% compared to traditional methods due to the immediacy of communication and ease of response for customers.

Successful contact rate measures what percentage of communication attempts result in a response from the customer. WhatsApp typically achieves contact rates of 80-90%, significantly higher than phone calls (30-50%) or emails (15-25%).

Operating efficiency metrics

Cost per peso recovered measures the economic efficiency of the collection operation, including personnel costs, technology, and other operating expenses. WhatsApp collection typically reduces these costs by 50-70% compared to traditional methods.

Productivity per agent measures how many accounts each member of the collections team can effectively handle. With proper automation, an agent can handle 3-5 times more accounts than using traditional methods.

The average time per case resolved indicates the efficiency of the collection process. WhatsApp enables faster resolution due to immediate two-way communication and the ability to share documents and receipts instantly.

Customer satisfaction metrics

The customer retention rate after collection processes measures what percentage of customers continue the business relationship after regularizing overdue accounts. WhatsApp friendly collections typically maintains retention rates of 85-95%.

Complaints and disputes related to collections processes should be monitored to ensure that practices meet legal and quality standards. WhatsApp collections typically reduces complaints by 60-80% due to the less intrusive nature of the communication.

The Net Promoter Score (NPS) specific to collections processes can be measured to understand the customer's perception of the collections experience and identify opportunities for improvement.

Segmentation analysis

Analyze metrics by customer segment to identify patterns and optimize specific strategies. Different types of customers (corporate vs. individual, new vs. returning, high vs. low value) may require different approaches.

It also analyzes performance by delinquency ranges (1-30 days, 31-60 days, 60+ days) to understand how effectiveness changes over time and adjust strategies accordingly.

Aurora Inbox provides automatic dashboards that visualize all these metrics in real time, facilitating data-driven decision making and quick identification of trends or issues that require attention.

Real success stories

The following success stories demonstrate the transformative impact of WhatsApp collections when implemented strategically with appropriate tools such as Aurora Inbox.

Case 1: Medical Products Distributor - Mexico

Initial situation: Family-owned company with 35% past-due accounts receivable and collection processes based on phone calls with low effectiveness.

Implementation: Complete migration to WhatsApp collections with Aurora Inbox, including automated sequences, integration with billing system, and team training on user-friendly collections.

Results in 6 months:

- Reduction in nonperforming loans from 35% to 12%

- Improvement in recovery rate from 45% to 78%

- 60% reduction in mean recovery time

- 25% increase in post-collection customer retention

- 70% reduction in collections operating costs

Case 2: Professional services company - Colombia

Initial situation: Consulting firm with cash flow problems due to late payments from corporate clients and inefficient collection processes.

Implementation: Hybrid system combining automated preventive reminders with personalized follow-up for high-value accounts, using Aurora Inbox for centralized management.

Results in 4 months:

- 50% reduction in average collection days

- 40% improvement in operating cash flow

- 85% increase in timely payments

- 90% reduction in billing-related disputes

- 30% improvement in customer satisfaction

Case 3: Retail store chain - Peru

Initial situation: Chain of 15 stores with in-house credit program and high delinquency on individual customer accounts.

Implementation: Segmented collection by WhatsApp with different strategies for frequent vs. occasional customers, full automation with Aurora Inbox, and integration with POS system.

Results in 8 months:

- Reduction of nonperforming loans from 28% to 8%

- 150% increase in recovery of past-due loan portfolio

- 65% improvement in collection equipment efficiency

- Reduction of 80% in uncollectible accounts

- 20% increase in credit sales due to improved risk management

Frequently asked questions about collection by WhatsApp

Is it legal to make collections by WhatsApp?

Yes, collection by WhatsApp is legal as long as the applicable regulations in each country are complied with, including appropriate schedules, respectful tone, and client authorization for communication by this means. It is important to document the authorization and maintain professional practices.

What times are appropriate for WhatsApp collections?

Generally between 8:00 AM and 8:00 PM on weekdays, avoiding weekends and holidays unless the customer has specifically authorized communication during these periods. Specific times may vary according to local regulations.

How to handle customers who do not respond to WhatsApp?

Implement an escalation process that includes other communication channels after reasonable attempts via WhatsApp. Document all attempts and consider factors such as phone number changes or technical issues before assuming intentional evasion.

What to do if a customer disputes the debt by WhatsApp?

Handles disputes in a professional manner, requesting specific documentation of the dispute, providing evidence of the debt when appropriate, and escalating to specialized personnel if necessary. Documents all communication related to disputes.

How to integrate WhatsApp with existing billing systems?

Aurora Inbox provides native integrations with popular billing and ERP systems, allowing automatic synchronization of customer data, account statements, and payment updates. It is also possible to develop custom integrations using APIs.

What metrics are most important to measure success in WhatsApp collections?

Key metrics include recovery rate, average recovery time, cost per weight recovered, successful contact rate, and post-collection customer retention. Aurora Inbox provides automated dashboards to monitor these metrics.

Transform your collection with Aurora Inbox

WhatsApp collection represents a transformative opportunity for SMEs looking to improve cash flow, reduce overdue receivables, and maintain positive customer relationships. However, successful implementation requires more than simply sending messages via WhatsApp.

Aurora Inbox provides the complete platform you need to implement professional and effective WhatsApp collections, including intelligent automation, integration with existing systems, legal compliance, and advanced analytics that continuously optimize your results.

With Aurora Inbox, you can:

- Automate customized collection sequences that are tailored to each customer

- Integrate seamlessly with your existing ERP and billing systems

- Maintain automatic legal compliance with local regulations

- Monitor performance in real time with intuitive dashboards

- Scale your collections operation without increasing staffing levels proportionally.

- Improve customer experience while maximizing portfolio recovery

Thousands of SMBs in Latin America have already transformed their collections with Aurora Inbox, achieving an average 70% improvement in recovery rates and a 60% reduction in operating costs.

Ready to transform your collections? Request a personalized demo of Aurora Inbox and discover how you can implement WhatsApp collections that generate exceptional results while maintaining positive relationships with your customers.

Optimize your business today!

Find out how Aurora Inbox's AI agent for WhatsApp can revolutionize your customer service. Schedule a meeting to meet with him and take your service to the next level.

We are here to help you grow!