How to collect money by WhatsApp in a professional and effective way

Step-by-step guide to implement professional collections via WhatsApp. From initial configuration to advanced strategies that improve portfolio recovery 60-80%.

Implementing WhatsApp collections professionally and effectively requires more than simply sending reminder messages. It is a systematic process that combines technology, communication strategy, and legal compliance to maximize portfolio recovery while maintaining positive business relationships.

SMBs that implement professional collections via WhatsApp report 60-80% improvements in recovery rates compared to traditional methods, 50-70% reduction in operating costs, and 40-60% increase in customer satisfaction during collections processes. These results are achieved through the systematic implementation of best practices that respect both business needs and customer rights.

This guide will provide you with a complete roadmap for implementing WhatsApp collections that generates exceptional results from day one, avoiding common mistakes that can compromise both effectiveness and legal compliance.

Initial preparation and configuration

Successful WhatsApp collection begins with meticulous preparation that lays the groundwork for professional and effective operations. This preparation includes technical, legal, and strategic aspects that will determine long-term success.

WhatsApp Business Configuration

Use WhatsApp Business instead of personal WhatsApp to project professionalism and access essential business features. Set up a complete profile that includes your company's official name, professional logo, clear description mentioning billing and collection services, physical address, business hours, and website.

The business description should set clear expectations: "Company XYZ - We use WhatsApp for business communication including billing, collections and customer service. Hours of operation: Monday through Friday 8:00 AM - 6:00 PM." This initial transparency prevents misunderstandings and establishes professionalism.

Set up automatic welcome messages that explain the purpose of the communication and set expectations for response times. Also set up out-of-hours absence messages that include alternate contact information for emergencies.

Documentation and legal compliance

Before initiating collections via WhatsApp, make sure you have explicit authorization from customers to communicate via WhatsApp. This authorization can be obtained during the initial sales process, through specific confirmation, or through opt-in in existing communications.

Develop internal policies that comply with local regulations on collection practices, including allowable hours, maximum frequency of communication, appropriate language, and procedures for handling disputes. Document these policies and train all personnel involved.

Establish documentation systems that record all collection communications, including dates, times, message content, and customer responses. This documentation is crucial for both internal tracking and legal compliance.

Data organization and segmentation

Organize your customer database with relevant information for collections: payment history, communication preferences, known financial situation, and any special circumstances that may affect your collections strategy.

Implement a tag system in WhatsApp Business that allows categorizing contacts according to account status: "Current", "Overdue 1-30", "Overdue 31-60", "Overdue +60", "On payment plan", "Disputed", etc. This organization facilitates systematic follow-up and the implementation of specific strategies.

Also segment by customer type (individual vs. corporate, new vs. recurring, high vs. low value) to customize the collections approach according to the specific characteristics of each segment.

Effective communication strategy

Effective communication in collections via WhatsApp requires a careful balance between professional firmness and human empathy, adapting the message according to the specific situation of the client and the stage of the collections process.

Principles of friendly collection

Friendly collections is based on the premise that most customers want to meet their obligations but may face circumstances that make it difficult to pay on time. This approach seeks to understand the customer's situation and find collaborative solutions.

Always start with a cordial tone that acknowledges the existing business relationship: "Hello [Name], I hope you are well. I'm contacting you regarding your account with us..." This approach reduces initial defensiveness and establishes a collaborative environment.

Use language that invites communication instead of demanding immediate payment: "I would like to know your situation to see how we can help you" instead of "You must pay immediately". This approach generates better response and provides valuable information about the customer's situation.

History-based personalization

Tailor your approach according to the customer's payment history. Customers with good histories deserve more consideration and flexibility, while customers with recurring delinquencies require more direct communication about consequences.

For customers with good track records, focus on resolving problems that may have caused the delay: "I see you have always been on time with your payments. Is there a problem with the invoice or payment method that I can help you resolve?"

For clients with recurring delinquencies, maintain professionalism but be more direct about expectations and consequences: "Your account has several late payments. We need to regularize this situation to keep your account active."

Strategic Timing

The timing of communication can significantly influence effectiveness. Avoid inconvenient times such as very early in the morning, during meal times, or late at night. Also respect holidays and weekends unless you have specific authorization.

For corporate clients, consider typical corporate payment cycles. Many process payments on specific dates of the month, so appropriate timing can facilitate faster resolution.

For individual clients, consider factors such as paydays (fortnights, end of the month) and avoid periods of high financial stress such as the beginning of the school year or high spending seasons.

Step-by-step collection process

A structured collections process ensures consistency, maximizes effectiveness, and provides multiple opportunities for the customer to regularize their situation before more severe measures are taken.

Step 1: Preventive reminder (3-5 days before due date)

Preventive reminders are one of the most effective tools to prevent late payments. Send these reminders 3-5 days before the due date to give the customer enough time to arrange payment.

Sample message: "Hello [Name], I hope you are well. I am writing to remind you that your invoice #[Number] for $[Amount] is due on [Date]. If you have already made payment, please ignore this message. If you have any questions, I'll be happy to help - thank you for your preference!"

This preventive approach typically reduces delinquency by 40-60% by giving clients the opportunity to arrange their payments before they are due.

Step 2: First post-vaccination communication (1-3 days later)

The first communication after the due date should maintain a friendly tone assuming that the delay may be due to an oversight or minor circumstance.

Sample message: "Hello [Name], I hope you are well. I wanted to contact you because I see that your invoice #[Number] for $[Amount] was due on [Date] and we have not received payment yet. If you have already made the payment, please share the receipt with me. If there are any issues, I would like to know your situation to see how we can help you."

This initial communication should be informative and collaborative, providing the customer with the opportunity to explain their situation or confirm that payment is in process.

Step 3: Intermediate follow-up (7-15 days after maturity)

Intermediate follow-up should express greater concern while maintaining openness to finding collaborative solutions.

Sample message: "Hi [Name], I have been trying to contact you about your invoice #[Number] for $[Amount] that is [X days] past due. I understand that unforeseen situations may arise and I would like to learn about your current situation to find a solution that works for both of us. We can consider a payment plan or adjust the dates according to your possibilities."

At this stage, it is important to offer specific options such as payment plans, early payment discounts, or alternative payment methods to facilitate resolution.

Step 4: Formal communication (30-45 days after expiration)

Formal communication should be more direct about consequences while continuing to offer resolution options.

Example message: "Dear [Name], your account has an overdue balance of $[Amount] corresponding to invoice #[Number] that is [X days] past due. It is important that we regularize this situation to keep your account up to date and avoid affecting your credit history. I offer you the following options: [Specific options]. Please confirm which option is best for you."

Step 5: Last chance (60+ days after maturity)

Last chance communication should be clear about immediate consequences while maintaining professionalism.

Sample message: "Dear [Name], after multiple attempts to contact you, your account remains $[Amount] over [X days] past due. To prevent this situation from being reported to credit bureaus and legal action, I need you to contact me by [Deadline] to regularize your account."

Automation and tools

Intelligent automation allows you to scale WhatsApp collection without losing the personal touch that makes it effective. The right tools can handle repetitive tasks while freeing up time for cases that require personalized attention.

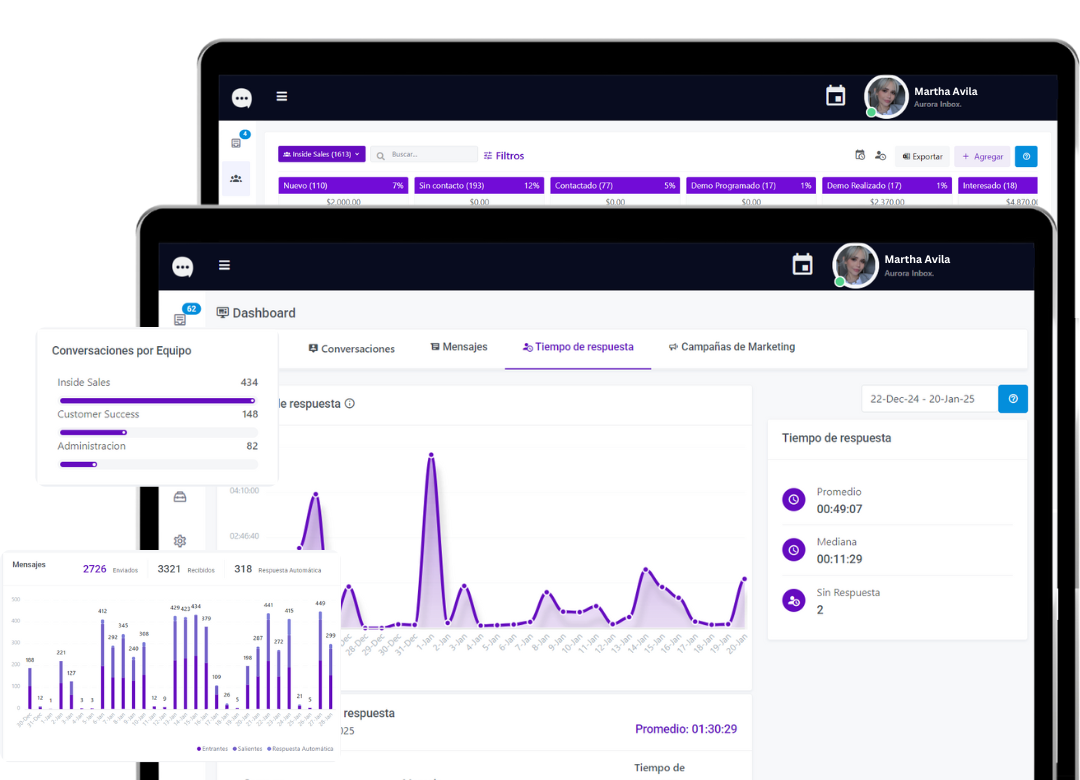

Automation with Aurora Inbox

Aurora Inbox transforms manual collections into an automated and intelligent system that adapts to the behavior of each customer. The platform can send automatic collection sequences customized with customer-specific information extracted from integrated billing systems.

The system automatically pauses sequences when the customer responds, transferring the conversation to a human agent for personalized handling. This combination of automation and human intervention optimizes both efficiency and effectiveness.

Aurora Inbox also uses artificial intelligence to analyze communication history and payment behavior, automatically adapting the tone, timing, and approach of messages to maximize the probability of positive response.

Integration with existing systems

Integration with billing and ERP systems eliminates the need for manual data updates and ensures that collection information is always up to date. When a customer makes a payment, the system automatically updates its status, pausing active collection sequences.

This real-time synchronization prevents inappropriate communications (such as sending reminders to customers who have already paid) and significantly improves the customer experience.

Metrics and continuous optimization

Implement measurement systems that track key metrics such as recovery rate, average recovery time, cost per weight recovered, and customer satisfaction. These metrics provide insights to continually optimize the strategy.

Aurora Inbox provides automatic dashboards that visualize these metrics in real time, facilitating the identification of trends and opportunities for improvement.

By systematically implementing these steps and tools, your company can transform collections from a reactive and costly process into a proactive and cost-effective operation that strengthens customer relationships while maximizing portfolio recovery.

Optimize your business today!

Find out how Aurora Inbox's AI agent for WhatsApp can revolutionize your customer service. Schedule a meeting to meet with him and take your service to the next level.

We are here to help you grow!