Customer-friendly collection strategies that maintain customer relationships

Proven WhatsApp friendly collection techniques that improve recovery 65% while maintaining positive business relationships. Collaborative vs. confrontational approach.

WhatsApp friendly collections represents a paradigm shift from traditional confrontational approaches to collaborative strategies that prioritize maintaining business relationships while maximizing portfolio recovery. This approach is not only more effective in terms of financial results, but also builds long-term customer loyalty.

Companies that implement friendly collection strategies report customer retention rates of 85-95% after collection processes, compared to 40-60% using confrontational methods. In addition, they achieve 45-65% improvements in recovery rates due to increased customer cooperation and reduced disputes.

This guide provides specific strategies, communication techniques, and frameworks for implementing friendly collections that transform a traditionally negative process into an opportunity to strengthen business relationships while effectively recovering past-due receivables.

Fundamentals of amicable collection

Amicable collections are based on fundamental principles that recognize the humanity of the debtor and seek mutually beneficial solutions rather than simply demanding immediate payment.

Principle of good faith

It assumes that most clients want to meet their obligations but may face temporary circumstances that make timely payment difficult. This principle completely changes the approach to communication from accusatory to collaborative.

In WhatsApp, this translates into messages that express understanding: "We understand that unforeseen situations may arise" instead of "You have defaulted on your payment obligation". This difference in tone generates more positive responses and greater willingness to collaborate.

Focus on solutions

Rather than focusing solely on the problem (past due payment), amicable collections focuses on finding solutions that work for both parties. This includes flexible payment plans, early payment discounts, or adjustments in terms that facilitate regularization.

WhatsApp facilitates this approach by enabling two-way conversations where options can be explored in real time, terms negotiated, and agreements reached that meet both the customer's needs and the company's recovery objectives.

Preservation of dignity

Friendly collections maintain customer dignity by avoiding intimidating language, threats, or communication that may be perceived as humiliating. This not only complies with legal regulations, but also facilitates customer cooperation.

In WhatsApp communications, this means using respectful language, avoiding sustained capitalization, and framing the situation as a problem to be solved together rather than a moral failing of the client.

Empathic communication techniques

Empathic communication is at the heart of friendly collections, allowing to build rapport with the customer and facilitate collaboration to resolve the payment situation.

Active listening and validation

When a client explains his situation, practice active listening by acknowledging his circumstances and validating his feelings without necessarily agreeing with all of his justifications.

Validation example: "I understand that the economic situation has been difficult for many families. I appreciate you sharing your situation with me so we can find a solution that works for both of us."

This validation reduces client defensiveness and creates a collaborative environment that facilitates the negotiation of realistic solutions.

Collaborative language

Use language that invites collaboration rather than creates confrontation. Words like "together," "collaborate," "find a solution," and "work with you" create an atmosphere of partnership rather than adversity.

Contrast "You must pay immediately" with "Let's work together to find a way to regularize your account that fits your current situation". The second approach generates a much better response.

Open-ended questions and exploration

Use open-ended questions to better understand the customer's situation and identify opportunities for creative solutions. "What payment options would be most convenient for you?" is more effective than "When are you going to pay?"

These questions also provide valuable information about the customer's ability to pay, allowing you to structure realistic agreements that are more likely to be fulfilled.

Personalization strategies by customer type

Effective amicable collection tailors the approach to the specific characteristics of the customer, the customer's history, and the particular circumstances of the past due account.

Customers with good payment history

For customers who are normally punctual, focus on resolving any problems that may have caused the delay. These customers typically want to resolve the situation quickly and appreciate that you recognize their good track record.

Sample message: "Hi [Name], I see your invoice is a few days past due, which is unusual considering your excellent payment history. Is there a problem I can help you solve? I'm here to find a quick solution."

New customers or customers with limited history

With new customers, focus on establishing a positive relationship while educating about payment policies and available options. These customers may be unfamiliar with your processes and appreciate clear guidance.

Sample message: "Hello [Name], as a new customer, I wanted to contact you personally about your past due invoice. I would like to explain our payment options and see how we can make the process more convenient for you."

Customers with known financial difficulties

For clients who have reported financial difficulties, focus on finding realistic solutions that recognize their limitations while ensuring some progress toward regularization.

Sample message: "Hi [Name], I understand that you are going through a difficult financial situation. I would like to work with you to find a payment plan that fits within your current means. What options would be most viable for you?"

Corporate Clients

With corporate clients, maintain professionalism while focusing on internal processes, payment cycles, and long-term business relationships. These customers often have specific procedures that must be followed.

Message example: "Dear, we understand that companies have specific internal processes for payments. Is there anything in our billing process that we can adjust to facilitate timely payment? We highly value our business relationship."

Handling objections and resistance

Even with friendly collections, customers may raise objections or resistance. Proper handling of these situations can turn resistance into collaboration.

Objections to the amount

When a customer disputes the amount, remain calm and focus on providing clarification without being defensive. Offer to review the invoice together and provide supporting documentation when necessary.

Sample response, "I understand your concern about the amount. I would like to go over the details of the invoice with you to make sure everything is clear. Could you tell me specifically what part you think is incorrect?"

Objections on timing

When a customer says he cannot pay at this time, he explores alternative timing options rather than insisting on immediate payment. This demonstrates flexibility and generates goodwill.

Sample response: "I understand that this time is not ideal for you. When would be more convenient? We can consider a payment plan or adjust the date according to your means."

Emotional resistance

Some clients may express frustration or anger. Maintain empathy without accepting abuse, and focus on redirecting the conversation toward constructive solutions.

Sample response: "I understand that this situation is frustrating for you. My goal is to help you resolve it in the most expedient way possible. Can we focus on finding a solution that works for both of us?"

Building sustainable agreements

Sustainable agreements are those that the customer can realistically meet, reducing the likelihood of future non-compliance and strengthening the business relationship.

Evaluation of ability to pay

Before proposing an agreement, assess the customer's real ability to pay based on the information provided and your knowledge of their situation. Unrealistic agreements only generate additional frustration.

Ask specific questions, "What monthly amount would be comfortable for you?" or "Would you prefer smaller payments over a longer time or larger payments over a shorter time?" This helps you structure workable agreements.

Flexibility in terms of

Offer multiple options that allow the customer to choose what best fits their situation. This may include payment plans, early payment discounts, or combinations of both.

Example of options: "I can offer you three options: 1) Full payment with 10% discount if you pay this week, 2) 3 monthly payment plan, or 3) 6 bi-weekly payment plan. Which one suits you best?"

Clear documentation of agreements

Once an agreement is reached, document it clearly in WhatsApp to avoid future misunderstandings. Include specific amounts, dates, and any special conditions.

Confirmation example: "Perfect, I confirm our agreement: You will pay $[amount] on [date], $[amount] on [date], and $[amount] on [date]. I will send you friendly reminders before each date - do you agree to these terms?"

Follow-up and maintenance of the relationship

Proper follow-up after payment agreements is crucial to ensure compliance while maintaining the positive relationship established during negotiation.

Proactive and friendly reminders

Send reminders prior to agreed payment dates, maintaining the friendly tone established during negotiation. These reminders should be helpful, not intimidating.

Reminder example: "Hello [Name], I hope you are well. I remind you that according to our agreement, the $[amount] payment is due on [date]. If you have any inconvenience, please contact me to adjust the plan."

Recognition of compliance

When a customer complies with agreed payments, acknowledge it positively. This reinforces the desired behavior and strengthens the business relationship.

Sample Acknowledgement: "Thank you for your timely payment of $[amount]. I greatly appreciate your commitment to our agreement. Your account is progressing excellently toward full regularization."

Managing non-compliance with understanding

If a customer defaults on an agreed payment, approach the situation with understanding before assuming bad faith. Many times there are legitimate circumstances that can be resolved with minor adjustments to the agreement.

Follow-up example: "Hi [Name], I see we did not receive the agreed payment by [date]. Is there a problem I can help you resolve? We can adjust the plan if necessary."

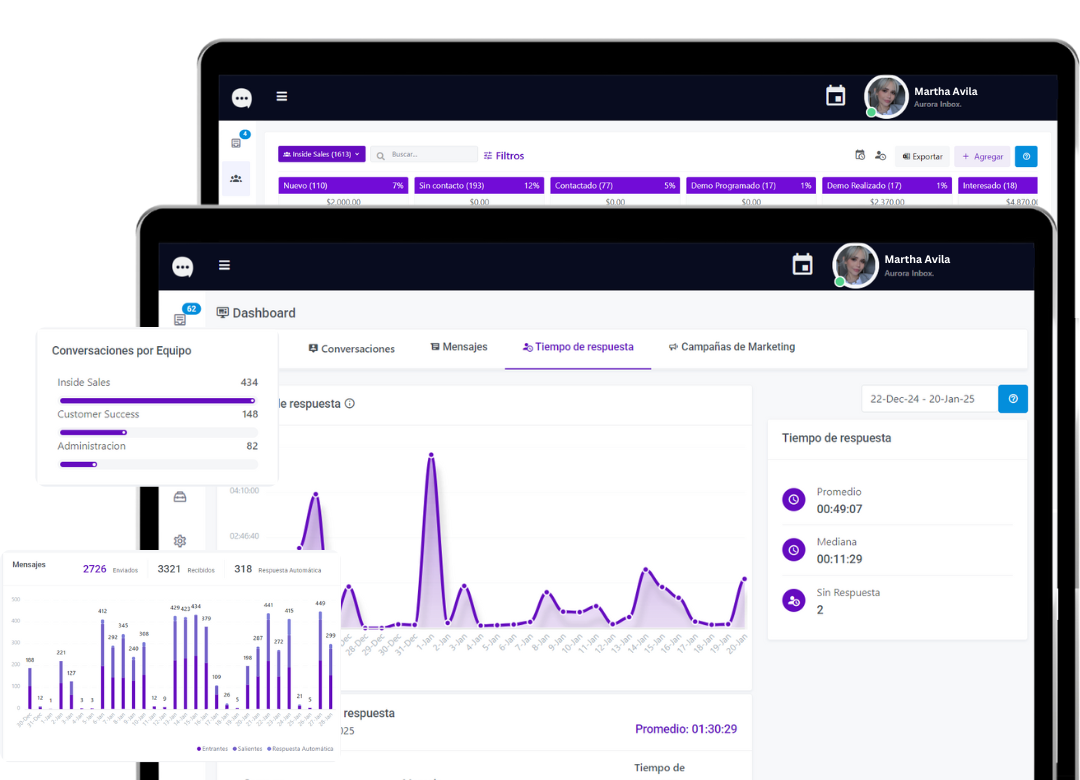

With Aurora Inbox, you can automate many aspects of friendly collections while maintaining the personal touch that makes it effective, including automatic message personalization, deal tracking, and alerts for human intervention when necessary, ensuring that every interaction strengthens the business relationship while maximizing receivables recovery.

Optimize your business today!

Find out how Aurora Inbox's AI agent for WhatsApp can revolutionize your customer service. Schedule a meeting to meet with him and take your service to the next level.

We are here to help you grow!